Table of Contents

- Introduction: The Million-Dollar Pricing Decision

- Marketplace Pricing Models: Beyond Commission

- Current Take Rate Benchmarks: What Are Other Marketplaces Charging?

- 8 Critical Factors That Should Determine Your Take Rate

- The Commission Setting Framework: A Step-by-Step Approach

- Advanced Marketplace Pricing Strategies

- Common Marketplace Pricing Mistakes to Avoid

- The Golden Rule of Marketplace Pricing

Introduction: The Million-Dollar Pricing Decision

As a marketplace founder, few decisions will impact your business as profoundly as your pricing strategy. Set your take rate too high, and you’ll drive away suppliers. Set it too low, and you might struggle to sustain your operations.

The commission you charge—also known as your “take rate” or “rake”—represents the percentage of each transaction that becomes your revenue. It’s the lifeblood of your marketplace business.

Many founders mistakenly believe that the optimal take rate is simply “as high as possible.” However, as legendary venture capitalist Bill Gurley points out in his classic essay A Rake Too Far, the exact opposite might be true. Lower take rates can often drive higher overall revenue by increasing transaction volume and marketplace liquidity.

This comprehensive guide will walk you through everything you need to know about setting the perfect take rate for your specific marketplace. We’ll examine real-world examples, explore the key factors that should influence your decision, and provide a practical framework for determining your optimal pricing strategy.

Marketplace Pricing Models: Beyond Commission

While this guide focuses primarily on commission-based pricing (taking a percentage of each transaction), it’s worth understanding the full spectrum of marketplace revenue models:

- Commission/Take Rate: Charging a percentage or flat fee from each transaction (Airbnb, Etsy, Uber)

- Subscription/Membership Fee: Charging recurring access fees (LinkedIn Premium, Care.com)

- Listing Fee: Charging to create or maintain listings (some categories on eBay)

- Lead Generation Fee: Charging for qualified customer inquiries (HomeAdvisor, Thumbtack)

- Freemium: Basic features free, premium features paid (many SaaS-enabled marketplaces)

- Featured Listings/Advertising: Charging for enhanced visibility (Yelp, TripAdvisor)

Many successful marketplaces use multiple revenue models simultaneously. For instance, Etsy combines commission (6.5%) with listing fees ($0.20 per item) and optional promotional services.

Current Take Rate Benchmarks: What Are Other Marketplaces Charging?

Understanding industry norms provides a useful starting point. Here’s what leading marketplaces are currently charging (as of 2025):

Service Marketplaces

- Uber/Lyft: 20-30% from drivers

- TaskRabbit: 15% service fee

- Fiverr: 20% from sellers

- Upwork: Sliding scale from 20% (first $500) to 5% (over $10,000)

Product Marketplaces

- Etsy: 6.5% + payment processing (3.5% + $0.25)

- eBay: 2-15% depending on category

- Amazon: 8-45% depending on category (15% average)

- StockX: 9.5-14% depending on item value

Rental Marketplaces

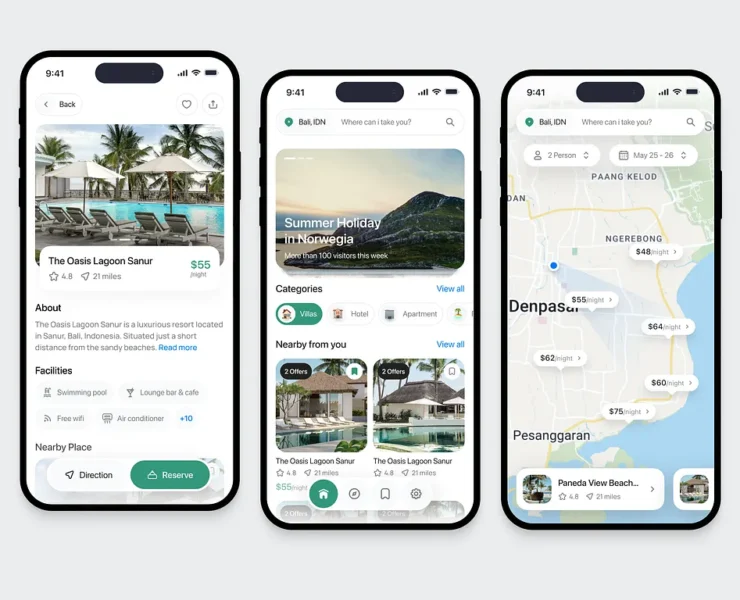

- Airbnb: ~17% total (typically 3% from hosts + 14% from guests)

- Turo: 15-40% depending on protection plan

- Swimply (pool rentals): 15% from hosts + 10% from guests

Specialized Marketplaces

- OpenTable (restaurant reservations): ~$1-2 per diner (~3%)

- Instacart (grocery delivery): 15-30% from retailers + delivery fees

- Thumbtack (home services): Variable lead fees or 15-20% service fee

According to our analysis of over 500 marketplaces, the average take rate across all categories is approximately 15%, with service marketplaces typically charging higher rates (20-30%) than product marketplaces (5-15%).

However, these benchmarks are just reference points. Your optimal take rate will depend on several critical factors specific to your marketplace.

8 Critical Factors That Should Determine Your Take Rate

The right commission for your marketplace depends on a complex interplay of factors. Let’s explore each one with clear examples:

1. Marginal Costs & Provider Profit Margins

The Principle: The thinner your providers’ profit margins, the lower your take rate must be.

Examples:

- Restaurant Delivery: Restaurants typically operate on 5-15% profit margins, which is why delivery platforms charging 30%+ have faced significant backlash and regulation in recent years. DoorDash has responded by introducing tiered commission options starting at 15% with reduced services.

- Digital Products: Platforms like Gumroad (selling digital goods) can sustain higher take rates (8.5% + $0.30) because sellers’ marginal costs are near zero after creating the initial product.

- Creative Services: Fiverr maintains a 20% take rate because freelancers often have relatively low operational costs besides their time, creating room for the platform to capture value.

Key Question: What percentage of transaction value represents pure profit for your providers?

2. Competitive Alternatives

The Principle: The more alternatives your providers have to reach customers, the lower your take rate must be.

Examples:

- Etsy initially set rates at approximately half of eBay’s to attract handmade sellers who had existing alternatives.

- Shopify disrupted marketplace dominance by offering merchants their own storefronts for a flat monthly fee instead of per-transaction commissions, allowing high-volume sellers to dramatically reduce costs.

- StubHub sustained a 15% buyer fee + 10% seller fee despite competition because they built superior trust features in the high-risk ticket resale market where fraud concerns outweighed price sensitivity.

Key Question: What other channels can your providers use to reach customers, and what do those channels cost them?

3. Network Effects Strength

The Principle: The stronger your network effects, the more pricing power you have once you achieve scale.

Examples:

- Ridesharing: Lyft successfully challenged Uber despite network effects because once a 3-minute pickup time is achieved in a market, additional drivers don’t significantly improve the customer experience, limiting network effect advantages.

- eBay commanded strong take rates in collectible categories where unique inventory created powerful network effects (collectors needed to access the largest pool of rare items), but struggled in standardized categories like electronics where alternatives were readily available.

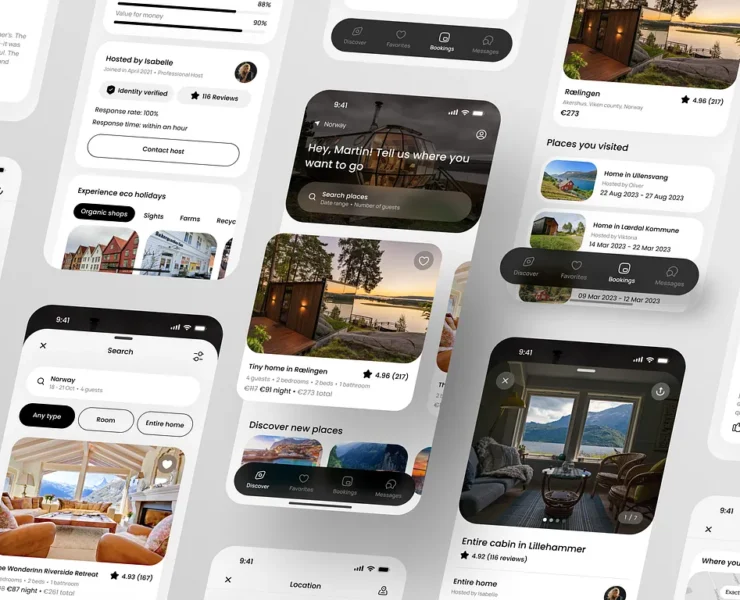

- Airbnb leverages strong network effects because travelers want access to the widest selection of unique properties, allowing them to maintain their commission structure despite numerous competitors.

Key Question: How much more valuable does your platform become to users with each additional participant?

4. Provider Differentiation

The Principle: High provider variance creates opportunities for tiered pricing models.

Examples:

- Upwork implemented a sliding commission scale (20% down to 5%) based on lifetime billings with each client, incentivizing long-term relationships while extracting more value from initial matches where they provide the most value.

- Airbnb offers “Superhost” status with various perks and potential for higher earnings, but doesn’t directly reduce commission rates for top performers.

- Amazon uses a Professional seller account ($39.99/month) with various benefits as an alternative to their Individual seller program, effectively creating different commission structures for different seller types.

Key Question: Do you have significantly different types of providers who might warrant different pricing approaches?

5. Transaction Size and Volume

The Principle: Larger transactions typically warrant lower percentage-based fees; higher volume can justify discounted rates.

Examples:

- Airbnb uses a sliding scale for guest fees (roughly 14% for lower-priced stays, decreasing to about 6% for luxury bookings) to avoid excessive fees on high-value transactions.

- Fiverr maintains a flat 20% regardless of transaction size because their name itself implies small transaction sizes, and $1 on a $5 transaction doesn’t feel excessive.

- StockX implemented a tiered seller fee structure (9.5-14%) that decreases based on seller level and sale price, rewarding both high volume and high-value transactions.

Key Question: How does your take rate translate to actual dollars across your range of transaction sizes?

6. Quality vs. Quantity Strategy

The Principle: High-quality, curated marketplaces can typically charge higher take rates than open marketplaces.

Examples:

- Toptal charges significantly higher fees than typical freelance platforms (estimated 20-40%) because they rigorously screen for only the “top 3%” of talent, creating premium value for clients.

- The RealReal (luxury consignment) maintains a 20-45% commission structure despite competition from platforms like Poshmark (20%) by providing authentication services and handling the entire selling process.

- MasterClass reportedly takes approximately 50% from instructors but provides professional production, marketing, and a premium brand association that justifies the high take rate.

Key Question: Are you providing additional value through curation, verification, or other quality-enhancing services?

7. Who Pays the Commission

The Principle: Place more of the fee burden on the less price-sensitive side of your marketplace.

Examples:

- Airbnb charges guests a higher percentage than hosts (approximately 14% vs. 3%) because acquiring quality supply (unique properties) was initially their constraint, and guests are typically less price-sensitive for short vacation stays.

- StubHub (and most ticket marketplaces) charge buyer fees rather than seller fees because sellers are extremely price-sensitive and will list wherever they can get the highest net payment.

- Instacart shifted from primarily charging grocery stores to implementing customer delivery fees and markups as they gained market power, recognizing that consumers valued convenience enough to absorb more of the cost.

Key Question: Which side of your marketplace is more constrained, and which is more price-sensitive?

8. Value-Added Services

The Principle: Additional services can justify higher take rates or create alternative revenue streams.

Examples:

- Etsy maintains a relatively low 6.5% base commission but generates significant additional revenue through optional services like Etsy Payments, Etsy Ads, and shipping labels.

- Turo offers tiered protection plans (15-40% commission range) where hosts can choose lower coverage for a lower take rate or comprehensive coverage for a higher take rate.

- Instacart offers Instacart+ subscription ($99/year) as an alternative revenue stream that reduces per-order fees for frequent customers while providing a predictable revenue source.

Key Question: What additional services could you offer that create value worth paying for?

The Commission Setting Framework: A Step-by-Step Approach

Based on the factors above, here’s a practical framework for determining your optimal take rate:

Step 1: Start with Baseline Benchmarks

Begin with industry averages for your specific marketplace type:

- Service Marketplaces: 15-30%

- Product Marketplaces: 5-15%

- Rental Marketplaces: 10-25%

- B2B Marketplaces: 5-15%

Step 2: Adjust Based on Provider Economics

Calculate how much profit your typical provider makes on a transaction, then determine what percentage of that profit you can reasonably capture without making the platform unattractive.

Example Calculation:

- Average transaction: $100

- Provider’s cost of goods/service: $60

- Provider’s profit before your commission: $40

- If you take 25% of profit ($10), provider keeps $30

- Your effective take rate: 10% of transaction value

This approach ensures your take rate aligns with provider economics.

Step 3: Factor in Competitive Landscape

Research all alternatives your providers have to reach customers:

- Direct channels (their own website, physical location)

- Competing marketplaces

- Traditional intermediaries

Your take rate should reflect the unique value you provide compared to these alternatives.

Step 4: Consider Split Commission Structures

Determine whether to charge the provider, the customer, or both:

Provider-Side Commission works best when:

- Customers are highly price-sensitive

- Customer acquisition is your primary constraint

- There’s significant competition for customers

Customer-Side Commission works best when:

- Providers are highly price-sensitive

- Provider acquisition is your primary constraint

- Customers value convenience over price

Split Commission works best when:

- Both sides derive significant value from the platform

- You want to create price transparency

- You need to keep individual fees feeling reasonable

Step 5: Test Multiple Approaches

Implement a structured testing program:

- Start with a slightly higher take rate than your long-term target

- Offer time-limited discounts to early adopters

- A/B test different rate structures with different user segments

- Collect data on how take rates impact transaction volume

Advanced Marketplace Pricing Strategies

Beyond basic commission structures, consider these sophisticated approaches:

Tiered Commission Structures

How It Works: Commission rates vary based on transaction volume, provider status, or other factors.

Examples:

- Upwork uses a sliding scale based on lifetime billings with each client (20% for first $500, 10% for $500.01-$10,000, 5% for $10,000+)

- Amazon charges different rates across 30+ product categories

- Etsy uses a standard 6.5% commission but offers Etsy Plus ($10/month) with additional benefits

When To Use: When you have significant variance in provider types, transaction sizes, or when you want to incentivize specific behaviors.

Value-Added Services Model

How It Works: Keep base commission low but offer premium services for additional fees.

Examples:

- Etsy offers promoted listings, pattern (website builder), and shipping labels as additional revenue streams

- Airbnb has added experiences, professional photography, and premium support tiers

- eBay provides store subscriptions with tiered benefits

When To Use: When providers have varying needs and willingness to pay for additional services.

Dynamic Pricing

How It Works: Commission rates fluctuate based on market conditions, time of day, or demand levels.

Examples:

- Uber and Lyft adjust take rates during surge periods

- Delivery platforms often modify their commission structure during peak demand times

- Ticketing marketplaces sometimes implement variable rates for high-demand events

When To Use: When demand fluctuates significantly and you provide extra value during peak periods.

Common Marketplace Pricing Mistakes to Avoid

Based on our experience with hundreds of marketplace startups, these are the most common pricing pitfalls:

1. Copying Competitors Without Understanding Context

The Mistake: Adopting the same take rate as established players without considering your unique value proposition or market position.

Example: Many food delivery startups initially copied Grubhub’s 30%+ commission structure without realizing this rate was only sustainable for Grubhub because of their dominant market position and significant consumer demand.

Solution: Understand the specific factors driving your competitors’ pricing strategies and adapt based on your unique situation.

2. Setting Rates Based on Financial Projections, Not Market Reality

The Mistake: Working backward from revenue goals instead of starting with what the market will bear.

Example: Many B2B marketplace startups project 10-15% take rates in their financial models, only to discover their target industry has extremely thin margins that can’t support such high fees.

Solution: Start with provider economics and competitive alternatives, then adjust your business model accordingly.

3. Failing to Communicate Value

The Mistake: Implementing fees without clearly articulating the value provided in exchange.

Example: When Etsy raised its transaction fee from 3.5% to 5% in 2018, they linked it directly to increased marketing spend and seller tools, helping providers understand the return on their increased costs.

Solution: Transparently communicate how your commission translates to value for providers and customers.

4. One-Size-Fits-All Pricing

The Mistake: Using identical pricing across different provider types, transaction categories, or geographic markets.

Example: Many rental marketplaces start with uniform pricing before realizing that high-value assets (luxury homes, exotic cars) can’t sustain the same percentage commissions as standard offerings.

Solution: Develop category-specific or tier-based pricing that reflects the different economics and competitive landscapes across your marketplace segments.

5. Premature Monetization

The Mistake: Implementing high take rates before establishing sufficient marketplace liquidity.

Example: Numerous niche marketplaces have failed by charging substantial commissions from day one, creating friction that prevented achieving critical mass.

Solution: Consider lower initial rates or time-limited discounts while building marketplace liquidity.

The Golden Rule of Marketplace Pricing

The single most important principle of marketplace pricing is this: Take as little as you need to build a sustainable business.

As Bill Gurley famously noted: “High rakes are a form of friction…For your platform to be the ‘definitive’ place to transact, you want industry-leading pricing—which is impossible if your rake is the de facto cause of excessive pricing.”

Lower take rates create several powerful advantages:

- More competitive pricing for end customers

- Higher supplier satisfaction and retention

- Reduced incentive for disintermediation (users circumventing your platform)

- Competitive moat against new entrants with higher fees

Amazon’s Jeff Bezos put it succinctly: “Your margin is my opportunity.” By keeping your take rate as low as possible while maintaining sustainability, you reduce the opportunity for competitors to undercut you.