Table of Contents

- Why Marketplace Taxes Suddenly Got Complicated

- What Are These Laws Actually Called?

- Am I Considered a “Marketplace” Under These Laws?

- Types of Taxes You Might Need to Handle

- When Do These Tax Rules Apply to Your Marketplace?

- The Global Picture: What Matters Where

- Real-World Examples of How This Works

- Seven Steps to Getting Taxes Right on Your Marketplace

- Directorism Tips for Marketplace Tax Success

Running an online marketplace is exciting—connecting buyers and sellers, scaling quickly, and disrupting industries. But there’s one aspect that often catches marketplace founders by surprise: tax compliance.

Having built hundreds of marketplaces for clients over the years, it’s inevitable that tax compliance eventually rises to high priority status in all projects. What begins as a back-office consideration rapidly becomes a business-critical function that can significantly impact a platform’s success or failure. In this article, I’ll break down everything you need to know about marketplace taxes in simple terms, without all the confusing tax talk.

Why Marketplace Taxes Suddenly Got Complicated

Remember when online sellers were responsible for their own taxes? Those days are mostly gone. In recent years, governments worldwide have decided that making every small seller figure out their own tax obligations was inefficient and led to massive non-compliance.

Their solution? Make the marketplaces themselves responsible.

This shift began in the US after the 2018 Supreme Court decision in South Dakota v. Wayfair, which allowed states to require out-of-state businesses to collect sales tax. States quickly realized it was easier to make Amazon collect tax on behalf of all its sellers than to chase thousands of individual merchants.

Today, this same trend is happening globally, with the EU, UK, Australia, and many other countries implementing similar rules.

What Are These Laws Actually Called?

Different regions use different terminology:

- In the US, they’re called “Marketplace Facilitator Laws”

- In the EU, they’re referred to as “Deemed Supplier Rules”

- In Australia, they fall under “Electronic Distribution Platform Rules”

Despite the different names, they all accomplish the same thing: shifting tax collection responsibility from individual sellers to the marketplace platform.

Am I Considered a “Marketplace” Under These Laws?

This is often the first question platform businesses ask. Generally, you’re considered a marketplace if you:

- Connect buyers and sellers (third-party)

- Facilitate the transaction in some way

- Process payments or handle the financial side of the transaction

If you’re just a listing directory that doesn’t collect payments for your sellers (like Craigslist), you might not qualify. But if you’re handling the money (like Etsy or Uber), you probably do.

Types of Taxes You Might Need to Handle

Different marketplaces face different tax challenges based on what they sell. Understanding these differences is crucial for proper compliance.

Physical Goods Marketplaces

If your platform sells tangible products (like Amazon, eBay, or Etsy), you’ll need to navigate a complex web of tax rules:

Sales Tax in the US:

- Each state has its own sales tax rate (ranging from 0% in states like Oregon to over 7% in California)

- Local jurisdictions (cities, counties) often add their own taxes on top of state rates

- Some cities like Chicago have special taxes on certain items (e.g., bottled water, soft drinks)

Product-Specific Complexities:

- Clothing is completely exempt in states like Minnesota but fully taxable in others

- Food has varying rules – groceries are exempt in many states but prepared food is usually taxable

- Health and medical products have their own exemptions that vary widely by state

Shipping and Handling:

- In states like New York, shipping charges are exempt if separately stated on the invoice

- In California, shipping charges are generally taxable when the sale is taxable

- Some states base taxation on shipping method (common carrier vs. company vehicle)

International Considerations:

- VAT (Value Added Tax) in Europe typically ranges from 17-27% depending on the country

- GST (Goods and Services Tax) in countries like Australia (10%) and Canada (5% federal plus provincial)

- Import duties may apply to cross-border transactions above certain thresholds

Real-World Example: A marketplace selling t-shirts would need to know that clothing under $110 is exempt from sales tax in New York, fully taxable in California, and subject to a reduced rate in Massachusetts. They would also need to determine if shipping is taxable in each jurisdiction and whether any local tax rates apply on top of state rates.

Source: Avalara – Physical Goods Marketplaces Compliance Challenges

Digital Product Marketplaces

Platforms selling e-books, software, or digital content face a different set of challenges:

Determining Place of Supply:

- In the EU, the place of taxation for B2C digital services is where the customer is located

- In the US, some states tax digital products while others don’t

- Multiple factors may determine customer location (IP address, billing address, payment method origin)

Digital Product Classification:

- What counts as a “digital product” varies widely between jurisdictions

- Some places distinguish between automated digital services and human services

- Classification affects whether the item is taxable and at what rate

Verification Requirements:

- Many jurisdictions require two non-contradictory pieces of evidence to determine customer location

- Some require storing evidence of customer location for years after the transaction

- Marketplaces often need technical solutions to capture and store this information

Special Registration Schemes:

- The EU’s One-Stop Shop (OSS) allows registration in one country for all EU digital sales

- Similar simplified registration schemes exist in other regions to reduce compliance burden

Real-World Example: A platform selling digital art downloads would need to verify that a customer is truly in Germany (perhaps through IP address and payment method) to charge the correct 19% German VAT rate. If they determined the customer was actually in France, they would need to charge 20% French VAT instead. The platform would need systems to verify, document, and store this location evidence.

Source: Stripe – Understanding the Tax Obligations of Marketplaces in the EU

Service Marketplaces

If your platform connects service providers with customers (like Uber, Airbnb, or TaskRabbit), you’re facing the most complex tax scenario:

Service-Specific Tax Rules:

- Personal services (haircuts, cleaning) have different tax treatment than professional services (legal, accounting)

- Educational services are often exempt but with varying definitions of what qualifies

- Healthcare services typically have their own special rules and exemptions

Location Complications:

- Services may be taxed where performed, where the customer is located, or both

- Multiple tax jurisdictions may claim authority over the same transaction

- Some services are considered “consumed” in different locations than where delivered

Special Industry Taxes:

- Hotel/occupancy taxes for short-term rentals (often 10-15% in major cities)

- Transportation taxes for rideshare (e.g., Chicago’s Ground Transportation Tax)

- Restaurant taxes for food delivery (some cities have specific meal taxes)

Responsibility Division:

- In some cases, both the marketplace and service provider have separate tax obligations

- The line between marketplace and provider responsibility varies by jurisdiction

- Some taxes apply to the service, others to the marketplace’s commission

Real-World Example: A rideshare platform like Uber needs different tax configurations for each city they operate in. In Chicago, they must collect the Ground Transportation Tax, in New York City they need to collect various surcharges including congestion pricing fees, and in California they face different local transportation taxes. Each location has its own rates, reporting requirements, and filing deadlines.

Source: Avalara – On-Demand Service Marketplace Compliance: Demanding

Hybrid Marketplaces

Many modern marketplaces sell a combination of physical goods, digital products, and services, creating even more complexity:

Platform-Specific Challenges:

- Different tax rules may apply to different parts of the same transaction

- Systems must distinguish between product types and apply appropriate tax rules

- Filing and reporting becomes more complex with mixed transaction types

Real-World Example: A platform like Amazon handles physical products (subject to sales tax), digital content (subject to digital goods taxation), and services like Amazon Home Services (subject to service tax rules). Each component requires separate tax determination logic, even within a single customer purchase.

Source: Fonoa – Tax Compliance for Marketplaces

When Do These Tax Rules Apply to Your Marketplace?

You don’t automatically have to collect taxes everywhere – you only need to worry about places where you have what’s called “nexus” (a significant connection to that location). Understanding when and where you have nexus is crucial for compliance.

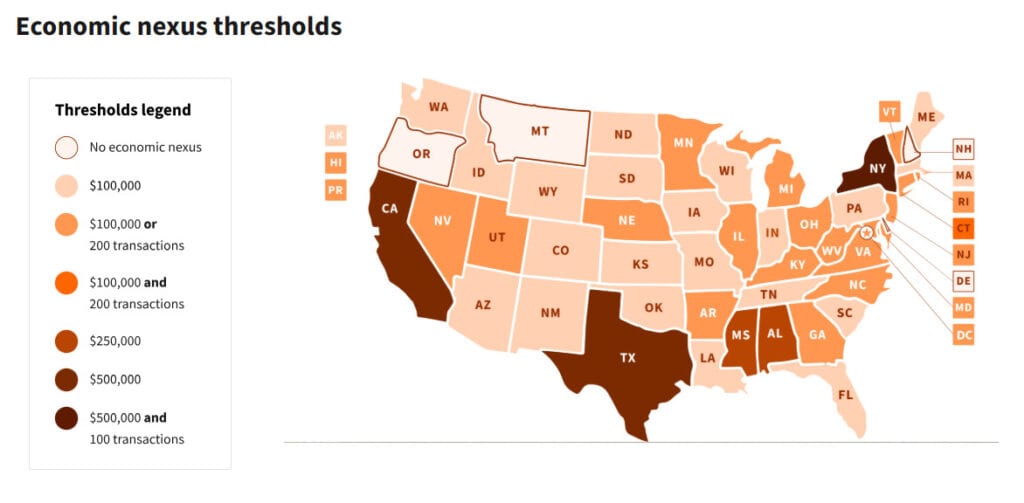

Economic Nexus: Sales-Based Obligations

Economic nexus is triggered when your sales or transaction volume in a jurisdiction exceeds specific thresholds:

US State Thresholds:

- Thresholds vary significantly by state:

- Kansas and Missouri don’t have transaction thresholds, only sales thresholds

- Some states use higher thresholds (Tennessee: $500,000)

- Texas uses $500,000 in sales without a transaction threshold

- Many states use $100,000 in sales OR 200 transactions annually (like Georgia, Illinois, Michigan)

- New York uses $500,000 in sales AND 100 transactions (both thresholds must be met)

- California and Texas use $500,000 in sales with no transaction threshold

- Kansas and Oklahoma use $100,000 in sales with no transaction threshold

- Colorado recently eliminated its transaction threshold, now only using the $100,000 sales threshold

- Most thresholds look at the previous or current calendar year, or the previous 12 months Once exceeded, you generally have 30-90 days to register and begin collecting tax

Important Details:

- Economic nexus applies to both direct sales AND sales through your marketplace sellers

- Some states include all sales in threshold calculations, while others only count taxable sales

- Crossing the threshold creates immediate tax collection obligations in most states

- Even if your sales drop below the threshold later, many states have “trailing nexus” requiring you to continue collecting taxes for a period (often 12 months)

Real-World Example: A marketplace selling handmade crafts has $90,000 in annual sales in Michigan and 180 transactions. They’re below both thresholds, so they don’t need to collect Michigan sales tax. However, if holiday sales push them over either $100,000 or 200 transactions, they would need to register and begin collecting Michigan sales tax within the timeframe specified by the state (typically within 30 days of exceeding the threshold).

Source: Avalara – State-by-State Guide to Economic Nexus Laws

Physical Nexus: Location-Based Obligations

You create physical nexus when your business has a tangible presence in a location. This automatically creates tax collection obligations regardless of your sales volume.

What Creates Physical Nexus:

- Having an office, store, or warehouse in the jurisdiction

- Employees working in the location (including remote workers)

- Storing inventory in the jurisdiction (including in fulfillment centers)

- Owning or leasing property in the location

- Attending trade shows or temporary events in some states

- Using sales representatives or contractors in the location

- Having affiliates with physical presence in the jurisdiction

Important Details:

- Physical nexus creates immediate tax collection obligations

- The specific activities that create physical nexus vary by jurisdiction

- Just one day of physical presence can create nexus in some states

- Economic nexus thresholds don’t matter if you have physical nexus – you must collect tax regardless of sales volume

Real-World Example: A marketplace headquartered in Texas with no employees elsewhere doesn’t need to collect California sales tax if they’re below California’s economic nexus threshold. However, if they hire just one remote employee who works from California, or store inventory in a California fulfillment center, they immediately create physical nexus and must register to collect California sales tax, regardless of their sales volume.

Source: Avalara – Do You Need to Collect Sales Tax on Online Sales?

International Nexus Considerations

Outside the US, similar concepts apply but with different terminology and thresholds:

European Union:

- €10,000 in annual cross-border B2C sales within the EU (for VAT purposes)

- If below this threshold, you can apply home country VAT rates

- Once exceeded, you must collect VAT based on each customer’s location

- Physical establishment in any EU country creates immediate VAT obligations

Australia:

- AUD $75,000 in sales creates GST registration requirements

- No transaction count threshold applies

- Unlike US thresholds that reset annually, this is a rolling threshold

United Kingdom:

- Post-Brexit, no minimum threshold for non-UK businesses selling to UK customers

- £85,000 threshold only applies to UK-established businesses

Canada:

- CAD $30,000 threshold in most provinces for GST/HST registration

- Quebec has a CAD $30,000 threshold plus 30,000 CAD in Quebec specifically

- Saskatchewan and British Columbia have their own provincial thresholds

Source: Avalara – State-by-State Guide to Marketplace Facilitator Laws

The Global Picture: What Matters Where

United States

- Nearly all states with sales tax now have marketplace facilitator laws

- Each state has different definitions and thresholds

- Both state and local taxes may apply

- Product taxability varies dramatically by state

European Union

The EU implemented significant VAT reforms in July 2021:

- Marketplaces are deemed the supplier (and responsible for VAT) for goods sold by non-EU sellers to EU customers

- Marketplaces are also responsible for VAT on imported goods worth less than €150

- The One-Stop Shop (OSS) system allows you to register in one EU country and file for all

United Kingdom

Post-Brexit, the UK has its own rules:

- 20% VAT applies to most goods

- Marketplaces are responsible for VAT on sales facilitated for overseas sellers

- Different thresholds apply compared to the EU

Australia and New Zealand

Both have implemented marketplace rules focused on:

- 10% GST in Australia, 15% in New Zealand

- Low-value imported goods have special provisions

- Electronic Distribution Platform rules make marketplaces responsible

Real-World Examples of How This Works

Let’s walk through some examples to make this more concrete:

Example 1: US Product Marketplace

Imagine you run a platform like Etsy. A seller in Oregon sells a handmade necklace to a buyer in California for $100:

- Nexus verification: You need to check if your marketplace has nexus in California. California’s economic nexus threshold is $500,000 in sales (with no transaction threshold). If your platform has over $500,000 in annual California sales, you have nexus there.

- Tax rate determination: You need to calculate the correct tax rate for the buyer’s specific location in California. The state base rate is 7.25%, but local district taxes can increase this to as high as 10.75% in certain jurisdictions (like parts of Los Angeles County).

- Product taxability check: You need to confirm jewelry’s tax status in California. Jewelry is fully taxable in California with no special exemptions or reduced rates.

- Tax collection: You collect the appropriate tax amount during checkout (e.g., 9.5% in Los Angeles = $9.50 on a $100 purchase).

- Fund segregation: You keep that tax money separate from your marketplace fees.

- Filing and remittance: You file a California sales tax return (typically quarterly) and send in the collected amount by the filing deadline.

- Seller documentation: You provide the seller with documentation showing you handled the tax collection and remittance.

Source: Avalara – State-by-State Guide to Marketplace Facilitator Laws

Example 2: European Digital Marketplace

You run a platform selling digital art downloads. An artist in Spain sells a digital artwork to a customer in Germany for €50:

- VAT responsibility: As the marketplace, you’re responsible for charging German VAT at the standard rate of 19% (this is the current confirmed rate as of 2023).

- Customer location verification: EU rules require you to collect and store two pieces of non-contradictory evidence of the customer’s location. This typically includes IP address geolocation and payment method country, but can also include billing address, phone country code, or bank details.

- VAT collection: You collect €9.50 in VAT during checkout (19% of €50).

- Reporting options: You report and pay this VAT either through:

- The One-Stop Shop (OSS) system if you’re registered in an EU country, which allows filing a single return for all EU sales

- A direct German VAT registration if you have no EU establishment

- VAT documentation: You must provide a VAT-compliant invoice that includes specific information like your VAT ID number, the VAT rate applied, and the total VAT amount.

Source: European Commission – VAT Rules for E-Commerce

Example 3: Global Services Marketplace

You operate a platform connecting language tutors with students worldwide. A tutor in France provides online lessons to a student in Canada:

- Service taxability: Educational services in Canada may be exempt from GST/HST, but this depends on specific criteria. Private tutoring services are generally taxable, while courses leading to certificates or diplomas might be exempt.

- Registration threshold: You need to verify if you’ve crossed Canada’s GST/HST registration threshold, which is CAD $30,000 in worldwide revenue to Canadian consumers over four consecutive calendar quarters for non-resident digital service providers.

- Provincial variations: Each province has different tax systems:

- In provinces with HST (like Ontario at 13%), you collect a single harmonized tax

- In provinces with GST and PST (like British Columbia), you may need to register for and collect both taxes separately

- Quebec has its own QST system with separate registration requirements

- Place of supply rules: For digital services like online tutoring, Canadian tax law generally considers the place of supply to be where the consumer resides, not where the service provider is located. The tutor’s location in France generally doesn’t affect Canadian tax obligations.

- Collection and remittance: If you exceed the threshold, you must register, collect the appropriate tax (which varies by province from 5% to 15%), and file regular returns.

Source: Canada Revenue Agency – GST/HST for Digital Economy Businesses

Seven Steps to Getting Taxes Right on Your Marketplace

Getting your tax approach right isn’t something you do once, but these steps will help you get on the right track:

1. Figure Out Where You Need to Collect Taxes

Start by understanding exactly where you have tax obligations:

- Track your sales by location to see where you’ve exceeded the sales thresholds

- Make note of any places where you have offices, employees, or inventory

- Create a list of places where you need to register, starting with the most important ones

Helpful tip: Start with places where you sell the most. You can’t fix everything at once, so focus on where you have the biggest tax exposure have nexus. You can’t fix everything overnight, so focus on where you have the most exposure.

2. Register for Tax Collection

Once you know where you have obligations:

- Sign up for tax permits in required locations

- Look into simplified registration options like Europe’s One-Stop Shop

- Create a calendar of when tax forms are due (they vary by location)

Helpful tip: Some places offer voluntary disclosure programs if you haven’t been compliant in the past. These can reduce penalties and limit how far back they look.

3. Implement Tax Calculation Technology

Manual calculation is impossible for marketplaces—you need technology:

- Integrate a tax engine that can handle global rates and rules

- Ensure it can deal with product/service-specific taxability

- Test thoroughly with transactions across different locations and product types

Stripe Tax & Stripe Connect: Specifically designed for marketplaces, Stripe offers a powerful combination of tax and payment solutions:

- Fully integrated solution: Natively built into Stripe with no third-party integrations required

- Global coverage: Automatically calculates and collects sales tax, VAT, and GST in all US states and 40 countries

- Product support: Handles both physical and digital goods and services

- Tax registration assistance: Stripe can help manage your tax registrations in the US with pre-filled application details

- Simple implementation: Add tax collection with a single line of code to your existing Stripe integration

- Registration insights: See where you might need to collect taxes based on your Stripe transactions

- Filing services: Connect with Stripe’s global partners to handle filing and remittance using your transaction data

- Marketplace-specific features: When combined with Stripe Connect, provides end-to-end support for multi-party marketplace transactions

4. Update Your Checkout Process

Your checkout flow needs to handle tax properly with clear documentation:

Checkout Experience Requirements:

- Clearly show tax amounts separately from product prices

- Display tax breakdowns for multi-item purchases when appropriate

- Collect necessary customer information for tax determination (address, business status)

- Handle tax exemption certificates for business buyers

- Make sure your terms of service mention tax collection responsibilities

Invoice and Receipt Requirements:

- Generate tax-compliant invoices/receipts that satisfy legal requirements:

- US requirements: Generally must show tax collected separately, include seller information, and transaction details

- EU requirements: Must include specific information like your VAT ID, customer’s VAT ID (for B2B), applicable tax rates, total tax amount, and legal business name and address

- Australia/New Zealand: Tax invoices must include the words “Tax Invoice,” ABN number, and GST amount

- Provide downloadable PDF documentation for both buyers and sellers

- Store all transaction records for the required retention period (typically 3-7 years in the US, 6-10 years in the EU)

- For marketplace transactions, clearly indicate whether the invoice is being issued on behalf of the seller or by the marketplace itself

Customer Communication:

- Be transparent with customers about who’s collecting tax

- Provide clear explanations of why tax amounts might differ based on location

- Include links to relevant tax policies or FAQs in confirmation emails

Helpful tip: Add a simple tooltip or information icon next to tax amounts during checkout that explains: “Tax is collected by [your marketplace name] as required by local tax laws” to reduce customer confusion and support inquiries.

Sources: Avalara – Marketplace Sales Tax Collection European Commission – VAT Invoicing Rules

5. Manage Seller Relationships

Your sellers need to understand the tax landscape too:

- Clearly communicate your tax collection policies

- Provide documentation of taxes collected on their behalf

- Explain their remaining tax obligations (income tax, taxes in jurisdictions where you don’t collect)

- Collect and verify tax information from sellers (tax IDs, business status)

Pro tip: Create a seller tax guide that explains in simple terms what you handle and what they’re responsible for.

6. Remit and Report Correctly

Collecting tax is only half the battle—you also need to:

- File returns on schedule in each jurisdiction

- Reconcile what you collected with what you’re reporting

- Maintain documentation for potential audits

- Issue required tax documents to sellers (like 1099-Ks in the US)

Pro tip: Consider automating the filing process. Several services can handle return preparation and filing across multiple jurisdictions.

7. Stay Updated and Adapt

Tax rules for marketplaces are constantly evolving:

- Monitor regulatory changes in your key markets

- Regularly review your tax determination systems for accuracy

- Adjust your processes as your business model or product offerings change

- Consider periodic reviews by tax professionals

Pro tip: Join industry associations or forums where marketplace tax changes are discussed. Often you’ll hear about changes before they’re widely publicized.

Directorism Tips for Marketplace Tax Success

A Reality Check for Early-Stage Founders: Let’s be honest – tax and legal stuff is painfully boring for most entrepreneurs. It’s dry, technical, filled with jargon, and probably the exact opposite of why you started building a marketplace in the first place. You want to create something exciting that connects people and solves real problems – not wade through tax codes and compliance regulations.

This entire article likely sounds incredibly overwhelming if you’re just starting out. The good news? You absolutely don’t need to worry about most of this right now.

Tax compliance is definitely a step that comes much later in your journey. Allocating precious resources to complex tax planning when you haven’t actually built a product yet isn’t just premature – it’s a dangerous distraction that can kill your momentum before you even get started.

Of course, taxes and compliance are important – nobody’s arguing that. But startup building requires ruthless prioritization. When you don’t have a product, when you don’t have a team, when you’re bootstrapping with limited funds, tax optimization should be nowhere near the top of your priority list.

We’ve seen this pattern countless times with clients who spend valuable time and money consulting tax specialists, accountants, and lawyers before they even have a functioning website. It’s a classic case of putting the cart before the horse. While understandable (everyone wants to “do things right”), it’s impossible to make every decision with perfect timing.

I’ve fallen into this trap myself, setting up a formal corporation structure way before it was actually needed, burning through precious startup capital on monthly accountant fees for a business that wasn’t generating significant revenue yet. That’s money that could have gone toward product development, customer acquisition, or simply extending my runway.

So please, don’t get overwhelmed by all the information in this article. If reading about marketplace tax compliance makes you break into a cold sweat, take a deep breath. The fact that you’re even thinking about taxes might actually be a good sign – it could mean you already have a functioning MVP with real traction and users eager to pay you! That’s when tax planning actually becomes relevant.

When the time comes for serious tax compliance – and you’ll definitely know when that is – this information will be waiting for you. Until then, focus on what actually matters: building something people want.

With that perspective in mind, here are stage-appropriate recommendations that won’t distract you from what really matters:

For Pre-Launch Startups

- Focus on building your core product first – Don’t let tax concerns distract you from creating something people want

- Use standard payment solutions – Services like Stripe handle basic calculations in most jurisdictions

- Keep simple financial records – Basic bookkeeping now prevents headaches later

- Consider general tax implications in your business model – Just be aware of potential triggers for marketplace status

For Early-Stage Marketplaces with Initial Traction

- Start thinking about compliance as you approach thresholds – But don’t let it distract from growth

- Choose technology that can grow with you – Platforms that handle marketplace taxes will save retrofitting later

- Focus on your largest market first – Perfect global compliance isn’t realistic or necessary now

For Growing Marketplaces

- Conduct basic compliance reviews – As you scale, address the most critical gaps

- Document major tax decisions – Having a record of your reasoning helps if questions arise later

- Research tax implications before major market expansions – Some jurisdictions require registration first

For Established Platforms

- Now’s the time to automate – Manual processes become unmanageable at scale

- Consider dedicated tax expertise – Either in-house or outsourced

- Use your compliance capabilities as a competitive advantage – Sellers value platforms that handle tax complexities

Remember: Each stage of growth brings different priorities. Address tax compliance at the appropriate time for your business’s development, not before it’s necessary or too long after it becomes important.

Source: Stripe – Guide to Marketplace Tax Compliance

Disclaimer: This article provides general information about marketplace taxation but should not be considered legal or tax advice. Tax laws change frequently, and specific situations may vary. Consult with qualified tax and legal professionals for guidance specific to your marketplace.