Table of Contents

- The Difference Between Improvement and Disruption

- Building on What You Know: The Value of Improvement Marketplaces

- The Untapped Goldmine: Why Non-Participants Hold the Key to Explosive Growth

- 4 Proven Strategies That Built Billion-Dollar Marketplaces

- Applying This Framework to Your Marketplace

- The 3 Levers of Marketplace Power: Which One Will You Pull?

- Breaking Habits: Why Human Psychology Makes Marketplaces Hard (And How to Win Anyway)

- Your Marketplace Blueprint: Two Paths to Building a Winner

Most digital marketplaces today merely improve upon existing transactions. They take what people were already doing and make it faster, cheaper, or more efficient. While this creates significant value, the most iconic marketplaces of our time did something far more powerful — they created entirely new types of transactions that enabled people who couldn’t participate before to suddenly enter the market.

This distinction has profound implications for marketplace founders. After studying dozens of successful marketplaces and interviewing several marketplace experts from top business schools, I’ve identified key frameworks that can help entrepreneurs unlock truly disruptive potential in their marketplace businesses.

The Difference Between Improvement and Disruption

Let’s first clarify the two primary types of marketplace innovation:

Improvement Marketplaces: These platforms superimpose infrastructure on existing markets, helping current participants transact more efficiently. They reduce friction, increase transparency, add insurance, or digitize processes.

Disruptive Marketplaces: These platforms enable participation among non-participants by creating entirely new transaction types. They don’t just make existing transactions better — they create transactions that weren’t happening at all.

Take Angi (formerly Angie’s List) as an example of an improvement marketplace. With a market cap around $5.6 billion, they’ve built a valuable business by making the home services market more efficient. Finding reliable contractors was traditionally difficult and time-consuming, and Angi streamlined this process for both homeowners and service providers.

But Angi didn’t fundamentally change who could participate. They didn’t bring new types of contractors into the market or enable new categories of homeowners to access services they couldn’t afford before.

Building on What You Know: The Value of Improvement Marketplaces

I completely understand that most of you build marketplaces in niches you know very well, enabling traditional businesses to transition to the digital world with your platform connecting buyers and suppliers. This approach is perfectly fine and has tremendous potential.

In fact, it’s considerably easier to improve an existing market than to build a completely new one like the disruptive examples we’ll discuss. Don’t get disheartened by the focus on revolutionary marketplaces—most of our clients at Directorism are successfully digitizing traditional industries, and they’re building valuable, profitable businesses.

There’s immense opportunity in bringing offline markets online, especially if you have deep industry knowledge and connections. A marketplace that helps independent bookstores sell inventory online, connects local farmers with restaurants, or digitizes a B2B procurement process can create substantial value without needing to invent an entirely new transaction type.

The key is understanding which approach you’re taking and optimizing your strategy accordingly. If you’re building an improvement marketplace, focus on reducing friction, building trust, and delivering a better experience than the status quo.

The Untapped Goldmine: Why Non-Participants Hold the Key to Explosive Growth

The real innovation opportunity lies in enabling people who previously couldn’t participate to enter the market. This requires asking: Why aren’t these people participating today? What barrier keeps them out? How can we create a transaction type that works for them?

A common mistake I’ve observed in marketplace startups is focusing on the wrong non-participants. Food delivery platforms provide a clear example. Many burned through capital by trying to convert people who rarely ordered delivery into power users through discounts and promotions. Once the promotions ended, these customers reverted to their normal behavior.

Meanwhile, the real opportunity was on the supply side. Many restaurants had no delivery capability at all because building their own infrastructure was too expensive. By providing a shared network of drivers and technology, delivery platforms could bring entirely new supply online — restaurants that had never offered delivery before.

The insight here is critical: Identify which side of your marketplace has the most significant non-participant opportunity.

4 Proven Strategies That Built Billion-Dollar Marketplaces

After analyzing the most successful disruptive marketplaces, I’ve identified four transaction types that unlock new participation:

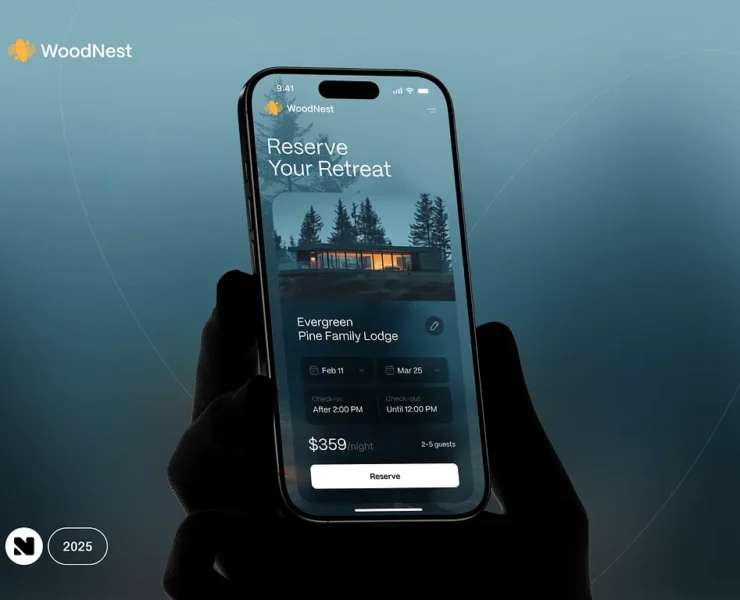

Strategy #1: The Smaller Unit Breakthrough – How Airbnb Unlocked a $100B+ Market

This approach breaks down existing supply into smaller, more accessible units. Airbnb exemplifies this strategy.

Before Airbnb, the primary option for travelers was hotels — full-service rooms with concierge, housekeeping, and other amenities. Airbnb created a transaction type around a smaller unit: a spare room in someone’s apartment with minimal services.

This smaller unit opened the market to two groups of non-participants:

- Travelers who couldn’t afford or didn’t want traditional hotels

- Ordinary people with spare rooms who would never have considered themselves in the accommodation business

What makes this truly disruptive is what happened next. As Airbnb improved its product, it began attracting mainstream hotel customers too. This is the hallmark of disruptive innovation — starting with non-participants, then moving upmarket to compete with traditional options.

Strategy #2: Breaking Entry Barriers – How Amazon Created Millions of New Sellers

This approach removes barriers that prevent potential suppliers from participating in a market. It’s about creating tools, infrastructure, or platforms that allow people with valuable skills or assets to monetize them for the first time.

Amazon Marketplace transformed retail by eliminating the technical and logistical barriers to opening an online store. Before Amazon Marketplace, selling products online required building a website, managing inventory systems, and establishing shipping operations—skills and investments beyond most small businesses. Amazon provided these tools in a simple package, allowing anyone with products to sell them globally overnight.

Substack and Patreon revolutionized content creation by allowing writers, podcasters, and artists to monetize directly from their audience. Previously, creators needed publishers, record labels, or galleries to reach an audience and get paid. These platforms eliminated gatekeepers and allowed creators to earn income directly from their fans—opening the market to countless creators who would never have secured traditional deals.

In each case, these platforms didn’t just make existing suppliers more efficient—they created entirely new categories of suppliers who previously couldn’t participate at all.

Strategy #3: Strategic Bundling – Turning Wasted Capacity Into Gold

The bundling approach aggregates unused or excess capacity from multiple suppliers and packages it as a new product that targets non-consumers without cannibalizing the suppliers’ core business.

ClassPass demonstrates this perfectly. Fitness studios faced a dilemma: they had empty spots in many classes but couldn’t sell them cheaply without undermining their premium membership pricing. The individual studios couldn’t solve this problem alone.

ClassPass created a solution by bundling access across hundreds of studios. They offered a new product (flexible access to diverse fitness options) to people who weren’t buying traditional memberships anyway. Studios filled empty spots with incremental revenue, while protecting their core membership business because the ClassPass experience (limited class selection, varied locations) was different enough from a dedicated membership.

OpenTable used a similar approach with restaurant reservations. Restaurants had empty tables during off-peak hours but couldn’t offer significant discounts without devaluing their regular service. OpenTable bundled these reservation slots across many restaurants and offered special pricing for off-peak dining. This attracted diners who wouldn’t normally eat at these restaurants during prime hours.

The key insight: bundling transforms excess capacity across multiple providers into a new product that serves previously excluded customers.

Strategy #4: Building Trust Bridges – Making “Impossible” Transactions Possible

Many potential transactions never happen because people don’t trust unknown counterparties. Trust wrappers create systems, guarantees, or verification mechanisms that make people comfortable enough to participate.

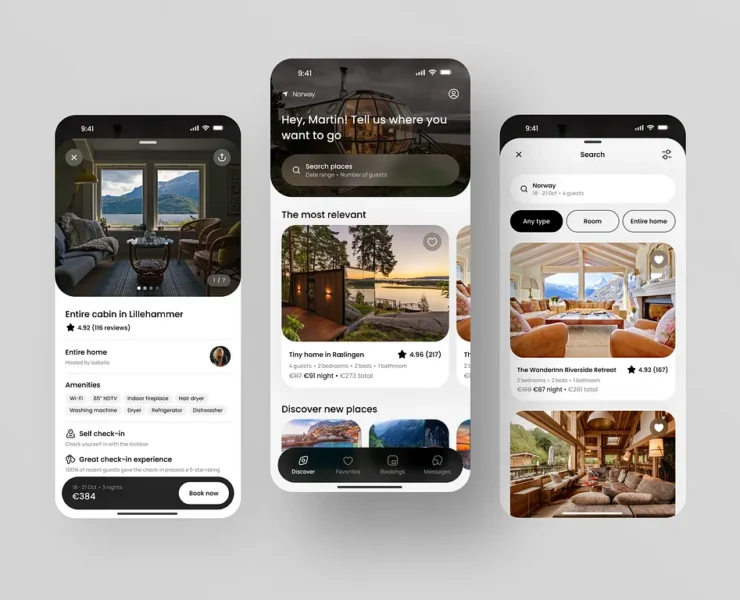

Airbnb faced an enormous trust barrier: convincing people to stay in strangers’ homes or let strangers into their homes. They built a sophisticated trust infrastructure including verified profiles, two-way reviews, secure payments, host guarantees, and eventually ID verification. Without these trust wrappers, most Airbnb transactions simply wouldn’t happen—the trust barrier was too high.

Uber encountered similar challenges. Getting into a stranger’s car was previously unthinkable for most people. Their trust wrappers included driver background checks, real-time trip tracking, two-way ratings, and a responsive support system. These mechanisms made a previously “unsafe” transaction feel secure enough for mainstream adoption.

Escrow services in online marketplaces represent another clear example. When eBay began, sending money to unknown sellers was risky. PayPal’s buyer protection program and eBay’s feedback system created enough trust for transactions to occur. Today, specialized marketplaces like StockX (sneakers) and GOAT (collectibles) use authentication services as trust wrappers—experts verify item authenticity before funds are released to sellers.

While blockchain technology does enable trustless transactions, practical applications like OpenSea (for NFTs) and decentralized exchanges still rely on reputation systems, verification protocols, and community governance to create the trust needed for widespread participation.

In each case, trust wrappers don’t just make existing transactions safer—they make entirely new classes of transactions possible by reducing perceived risk to acceptable levels.

Applying This Framework to Your Marketplace

To apply this framework to your own marketplace idea, start by asking:

- Am I building for existing participants or non-participants?

- What is the primary source of value loss in this market?

- Why aren’t transactions happening today?

- Which side of my marketplace has the most significant non-participant opportunity?

Understanding these questions will help you identify which of the four transaction types might work for your marketplace.

The 3 Levers of Marketplace Power: Which One Will You Pull?

Once you’ve identified your transaction type, you’ll need to focus your marketplace design on one of three dimensions:

1. Curation: The Quality Assurance Lever

What it is: Curation controls which transactions can happen in your marketplace by setting standards, vetting participants, and ensuring quality.

When to focus here: Make curation your primary focus when the market’s biggest problem is quality uncertainty or trust in the supply side.

How it creates value: Curation reduces risk for buyers, justifies premium prices for suppliers, and builds marketplace brand reputation.

Examples in action:

- StockX revolutionized sneaker reselling by authenticating every pair before delivery, eliminating the counterfeit risk that plagued eBay and other platforms.

- Superhuman email app maintains a waiting list and personal onboarding process, ensuring every user meets certain standards and understands the product.

- The RealReal has built a luxury consignment business around expert authentication, with certified gemologists, horologists, and art curators examining each item.

When curation is your lever, invest heavily in verification systems, detailed standards, and quality control processes—even if it slows growth initially.

2. Matching: The Discovery Lever

What it is: Matching helps the right buyers find the right sellers through search, recommendations, algorithms, and filters.

When to focus here: Make matching your primary focus when the market’s biggest problem is high search costs or complex preference matching.

How it creates value: Great matching increases conversion rates, improves transaction satisfaction, and enables premium positioning.

Examples in action:

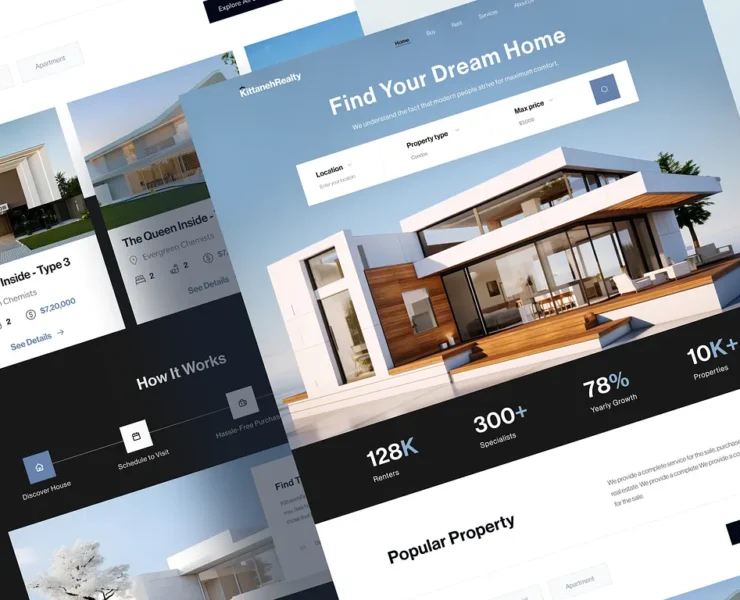

- Zillow became dominant in real estate by creating superior search and filtering tools that help buyers find properties matching specific criteria.

- Dating apps like Hinge succeed or fail based almost entirely on their matching algorithms—the better the matches, the more valuable the platform.

- Upwork uses sophisticated job matching algorithms that consider past project success, skill verification, and response patterns to connect clients with appropriate freelancers.

When matching is your lever, invest in data science, user preference mapping, and sophisticated recommendation systems that improve with platform usage.

3. Support: The Transaction Friction Lever

What it is: Support provides tools and services that help transactions complete successfully—payment processing, contracts, communication channels, dispute resolution, insurance, and logistics.

When to focus here: Make support your primary focus when the market’s biggest problem is complexity, risk, or friction in completing transactions.

How it creates value: Strong support increases conversion rates, enables higher transaction values, and builds participant loyalty.

Examples in action:

- Stripe transformed online payments by reducing integration complexity from months to minutes, enabling thousands of new businesses to accept online payments.

- Opendoor revolutionized home selling by handling inspections, repairs, photography, listings, and showings—eliminating transaction complexity that prevented many homeowners from selling.

- Escrow.com enables high-value transactions between untrusted parties by holding funds until contractual obligations are met.

When support is your lever, invest in streamlining processes, providing guarantees, and eliminating every point of friction in the transaction journey.

Identifying Your Primary Lever

While all marketplaces need some level of curation, matching, and support, identify which dimension most directly addresses your market’s principal pain point. This becomes your “superpower“—the area where you’ll invest disproportionately and innovate most aggressively.

Ask yourself:

- Which dimension, if dramatically improved, would unlock the most transactions?

- What do participants complain about most in the current market?

- Where do most potential transactions break down today?

Your answer reveals which lever will drive your marketplace’s competitive advantage and strategic focus.

Breaking Habits: Why Human Psychology Makes Marketplaces Hard (And How to Win Anyway)

What makes marketplace businesses particularly challenging is that they require fundamental changes in human behavior.

Unlike selling a better shoe or tastier snack, which fits into existing behavior patterns, marketplaces ask people to transact in entirely new ways. This creates resistance that must be overcome with compelling value.

The chicken-and-egg problem of marketplaces can be reframed as a behavioral challenge. Suppliers won’t join without buyers, and buyers won’t come without suppliers. But at a deeper level, both sides are asking: “Is this new behavior worth changing my habits for?”

Your marketplace must create enough value to overcome this resistance. For iconic marketplaces like Airbnb, Uber, or Etsy, the answer was clearly yes — they created so much value that they permanently changed consumer and supplier behavior.

Your Marketplace Blueprint: Two Paths to Building a Winner

As you build your marketplace, consider which path makes the most sense for your skills, resources, and market knowledge:

The Improvement Path

If you’re digitizing an industry you know well, focus on solving the specific pain points that make current transactions difficult. Your advantage is your industry expertise and understanding of existing players. Your goal is to make transactions so much better that you become the default way people do business.

Many of our Directorism clients have built seven and eight-figure businesses by simply being the best digital solution in a traditional industry. They didn’t need to reinvent the wheel—they just made it roll more smoothly.

The Disruption Path

If you’re pursuing disruption by enabling non-participants, recognize that this is a longer, more uncertain journey. It requires a deep understanding of why people aren’t participating today and a thoughtful approach to creating transaction types that work for them. It demands patience—many disruptive marketplaces took years before seeing significant growth.

But for those who get it right, the rewards are extraordinary. By bringing new participants into a market, you don’t just take a slice of an existing pie—you bake an entirely new one.

The next generation of iconic marketplaces will include both types. Some will make existing industries dramatically more efficient, while others will create entirely new transaction types. Both approaches can create tremendous value when executed with clarity and purpose.

The key is knowing which game you’re playing and optimizing your strategy accordingly.

And that’s the true power of marketplace innovation—whether you’re improving what exists or creating something entirely new.