The Truth About Funding Marketplaces: What Actually Works

One of the biggest decisions a marketplace founder faces is how to fund their startup. Should you bootstrap and grow organically, or should you raise external capital to scale quickly? While both have their merits, the best approach for marketplaces specifically is often raising capital. Here’s why.

The Unique Funding Challenges of Marketplaces

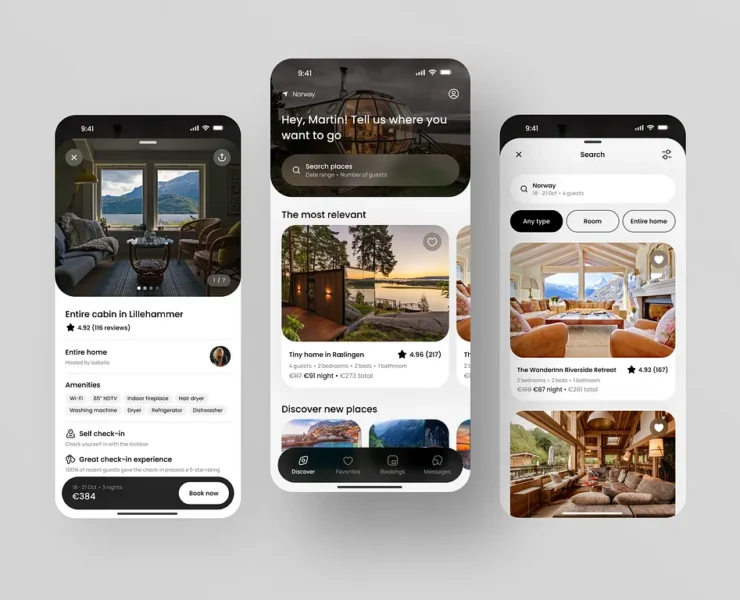

Unlike traditional SaaS businesses or e-commerce stores, marketplaces require both supply and demand to function. That means you can’t just launch with a product and expect immediate revenue—you need to build a healthy ecosystem first.

Here’s why this makes funding a marketplace especially difficult:

- The Chicken-and-Egg Problem – You need buyers to attract sellers and vice versa.

- Trust & Liquidity Take Time – Unlike e-commerce, where you sell products immediately, marketplaces take months (or years) to establish liquidity.

- Low Margins Initially – Most marketplaces take a commission per transaction, meaning you don’t generate real revenue until transactions are frequent.

- Heavy Early Investments – You may need subsidies, buyer incentives, and seller onboarding efforts to kickstart engagement.

Why Raising Capital is the Better Choice for Marketplaces

While bootstrapping works well for some businesses, marketplaces operate on network effects—meaning you need capital to reach critical mass before competitors do. Here’s why raising capital is often the smarter move:

1. You Need to Move Fast

Marketplaces are winner-takes-most businesses. If a competitor reaches liquidity first, they dominate. Look at Uber vs. Lyft—Uber’s aggressive funding helped them expand faster, making it nearly impossible for Lyft to catch up globally.

2. Supply & Demand Must Be Subsidized

To attract buyers, you need sellers. To attract sellers, you need buyers. That often means offering incentives (e.g., discounts, cashbacks, free trials) to kickstart activity. This requires significant upfront investment, which bootstrapping rarely allows.

3. Marketing & Trust Require Capital

Unlike traditional e-commerce, marketplaces require trust-building efforts. You need:

- Reviews & reputation systems (which take time to build)

- Payment protections & escrow services

- Customer support teams to handle disputes These are costly but essential for long-term success.

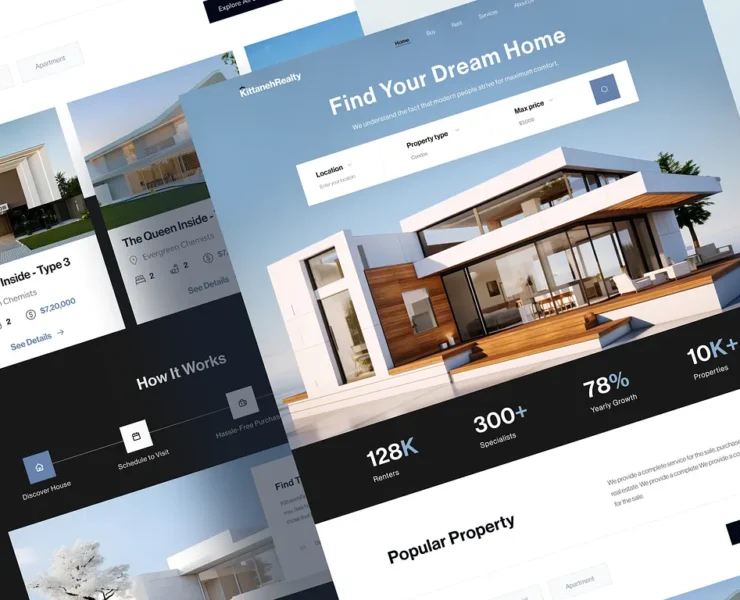

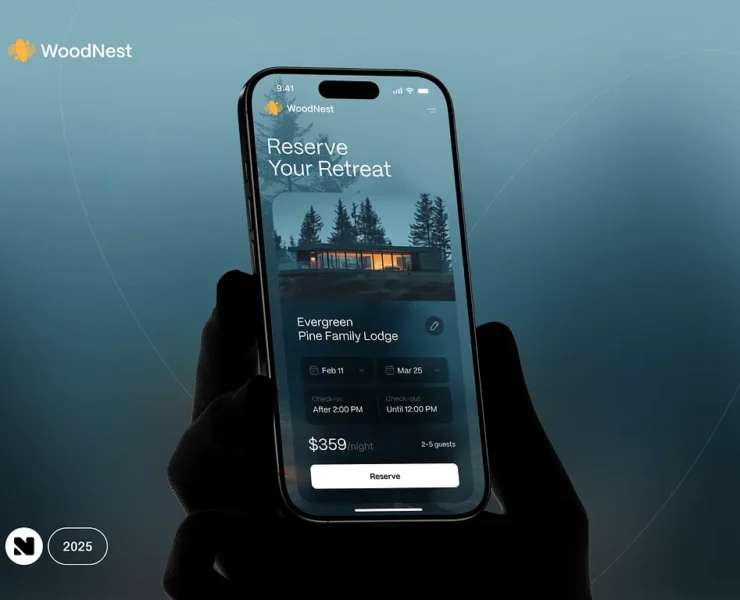

4. Technology Costs Are Higher

A marketplace isn’t just a simple e-commerce website—it requires advanced search, filtering, messaging, payment processing, and fraud prevention. This means a higher development cost upfront, making bootstrapping extremely difficult.

When Bootstrapping Can Work

That said, bootstrapping can work in certain cases:

- If your marketplace is hyper-niche (e.g., a local or highly specialized industry with little competition)

- If you already have an audience (e.g., a strong social following or industry connections that let you onboard users organically)

- If your model is high-margin (e.g., a subscription-based marketplace where revenue comes from suppliers, not transactions)

The Ideal Approach: A Hybrid Model

Many successful marketplace founders bootstrap initially to prove traction, then raise capital once they have validated demand. This way, they retain early control while securing funding when it truly matters.

Final Verdict: Raising Capital Wins for Most Marketplaces

If your goal is to build a scalable and high-growth marketplace, raising capital is often the best route. Network effects favor the fastest-growing player, and external funding allows you to accelerate growth, outpace competitors, and dominate your niche.

Bottom Line: Bootstrapping works for certain marketplace models, but for most, raising capital is the best strategy for long-term success.